LAWSUITS NEWS & LEGAL INFORMATION

California Overtime Violations on Bonuses

Were you looking for California - Overtime Violations lawsuits?

Companies that do not properly pay their California employees for overtime hours may be in violation of California overtime laws. Specifically, employees who earn bonuses, commissions or shift differentials may not be paid adequately for their overtime work and could be eligible to file an overtime rate violations lawsuit. California labor law requires companies to factor in applicable wage augments when calculating overtime pay.

Under the Fair Labor Standards Act (FLSA), overtime pay includes time worked over 40 hours in one week. Once an employee has worked more than 40 hours in a week, overtime pay—pay at a rate of one-and-a-half times the regular rate of pay—begins.

Under the Fair Labor Standards Act (FLSA), overtime pay includes time worked over 40 hours in one week. Once an employee has worked more than 40 hours in a week, overtime pay—pay at a rate of one-and-a-half times the regular rate of pay—begins.

The regular rate of pay upon which overtime pay is calculated includes hourly wages, salaries and wage augments, such as shift differentials, longevity pay or bonuses. This means employees who receive wage augments must be paid an overtime wage that factors in those wage augments.

According to the Fair Labor Standards Act, "any money received by an employee 'for work' is part of the employee's regular rate of pay." Wage augments must be factored into the regular rate when determining overtime pay.

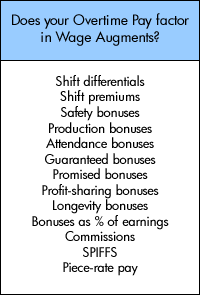

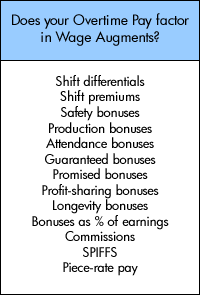

The following wage augments must be factored into overtime pay rates:

Shift differentials (i.e., paid at different rates) or shift premiums

Non-discretionary bonuses (such as safety bonuses, production bonuses, attendance bonuses, guaranteed/promised bonuses, profit-sharing bonuses, longevity bonuses, or bonuses paid as a percentage of earnings)

Commissions or SPIFFS (immediate bonus for sale)

Piece-rate pay

In addition to unpaid overtime, these employees are often owed significant penalties as a result of their employers underpaying them for overtime work performed.

While the FLSA stipulates that overtime pay must be paid for hours worked more than 40 hours in a week, individual states may also have overtime laws requiring employers to pay overtime once an non-exempt employee works over 8 hours in a day. Check with your state labor department to find out your specific state's overtime laws.

While the FLSA stipulates that overtime pay must be paid for hours worked more than 40 hours in a week, individual states may also have overtime laws requiring employers to pay overtime once an non-exempt employee works over 8 hours in a day. Check with your state labor department to find out your specific state's overtime laws.

California labor law, for example, mandates that California workers be paid overtime when more than 8 hours have been worked in a day.

So for California workers, overtime pay begins once an employee has worked over 8 hours in a day. The rate at which California overtime is paid must be based on the employee's hourly wages--but any wage augments such as shift premiums, shift differentials, non-discretionary bonuses, sales commissions, SPIFFS, 'good attendance' bonuses or piece-rate pay must be factored into hourly wages in order to calculate overtime pay.

For example, if a California employee ordinarily makes $12/hour, but has worked a special shift that pays a shift differential (such as a graveyard shift) putting his hourly rate at $15/hour, overtime hours worked during that pay period need to factor in that wage augment (i.e., shift differential) in calculating the worker's overtime pay.

If you suspect that your overtime pay rate does not factor in certain wage augments or pay differentials that you've earned, you may have been subject to a California overtime bonus violation.

Last updated on

FREE CALIFORNIA BONUS VIOLATION LAWSUIT EVALUATION

Send your California Bonus Violation claim to a lawyer who will review your claim at NO COST or obligation.

GET LEGAL HELP NOW

GET LEGAL HELP NOW

California Overtime Rate Violations

Under the Fair Labor Standards Act (FLSA), overtime pay includes time worked over 40 hours in one week. Once an employee has worked more than 40 hours in a week, overtime pay—pay at a rate of one-and-a-half times the regular rate of pay—begins.

Under the Fair Labor Standards Act (FLSA), overtime pay includes time worked over 40 hours in one week. Once an employee has worked more than 40 hours in a week, overtime pay—pay at a rate of one-and-a-half times the regular rate of pay—begins.The regular rate of pay upon which overtime pay is calculated includes hourly wages, salaries and wage augments, such as shift differentials, longevity pay or bonuses. This means employees who receive wage augments must be paid an overtime wage that factors in those wage augments.

According to the Fair Labor Standards Act, "any money received by an employee 'for work' is part of the employee's regular rate of pay." Wage augments must be factored into the regular rate when determining overtime pay.

The following wage augments must be factored into overtime pay rates:

Shift differentials (i.e., paid at different rates) or shift premiums

Non-discretionary bonuses (such as safety bonuses, production bonuses, attendance bonuses, guaranteed/promised bonuses, profit-sharing bonuses, longevity bonuses, or bonuses paid as a percentage of earnings)

Commissions or SPIFFS (immediate bonus for sale)

Piece-rate pay

In addition to unpaid overtime, these employees are often owed significant penalties as a result of their employers underpaying them for overtime work performed.

California Overtime vs FLSA Overtime Guidelines

While the FLSA stipulates that overtime pay must be paid for hours worked more than 40 hours in a week, individual states may also have overtime laws requiring employers to pay overtime once an non-exempt employee works over 8 hours in a day. Check with your state labor department to find out your specific state's overtime laws.

While the FLSA stipulates that overtime pay must be paid for hours worked more than 40 hours in a week, individual states may also have overtime laws requiring employers to pay overtime once an non-exempt employee works over 8 hours in a day. Check with your state labor department to find out your specific state's overtime laws.California labor law, for example, mandates that California workers be paid overtime when more than 8 hours have been worked in a day.

So for California workers, overtime pay begins once an employee has worked over 8 hours in a day. The rate at which California overtime is paid must be based on the employee's hourly wages--but any wage augments such as shift premiums, shift differentials, non-discretionary bonuses, sales commissions, SPIFFS, 'good attendance' bonuses or piece-rate pay must be factored into hourly wages in order to calculate overtime pay.

For example, if a California employee ordinarily makes $12/hour, but has worked a special shift that pays a shift differential (such as a graveyard shift) putting his hourly rate at $15/hour, overtime hours worked during that pay period need to factor in that wage augment (i.e., shift differential) in calculating the worker's overtime pay.

If you suspect that your overtime pay rate does not factor in certain wage augments or pay differentials that you've earned, you may have been subject to a California overtime bonus violation.

California Overtime Violations Legal Help

If you or a loved one has suffered damages in this case, please click the link below and your complaint will be sent to a lawyer who may evaluate your claim at no cost or obligation.Last updated on

CALIFORNIA BONUS VIOLATION LEGAL ARTICLES AND INTERVIEWS

Attorney Says California Overtime Bonus “Miscalculations” are Violations

Overtime Bonus Lawsuits

.jpg)

Overtime Bonus Violations Lawsuits on the Rise

November 16, 2012

Are Californians still overworked and underpaid? According to employment law attorney David Yeremian they are, and overtime claims are increasing. One major issue accounting for the rise has to do with overtime bonus violations. READ MORE

Overtime Bonus Lawsuits

.jpg)

October 7, 2012

As far as employment lawsuits go, overtime bonus lawsuits could be catching up with wage lawsuits and gender discrimination lawsuits in number of claims filed. Overtime rate violations lawsuits, in which plaintiffs allege their overtime pay was not properly calculated, are filed when employers fail to include non-discretionary bonuses when determining overtime pay. READ MORE

Overtime Bonus Violations Lawsuits on the Rise

September 28, 2012

As times get tougher for workers, more employees are filing overtime rate violations lawsuits and wage-and-hour lawsuits against their employers, alleging they were improperly paid for hours worked. Although some employers do not realize they have committed overtime bonus violations by not including bonus pay when calculating overtime rates, employees still deserve to be paid for all hours worked. More and more often, those employees are now filing an overtime bonus lawsuit or a wage-and-hour lawsuit to collect money owed to them. READ MORE

READ MORE Employment Settlements and Legal News

READER COMMENTS

Karen Miles

on

Can you help?

Bernie

on

Brad Lengyel

on

Separately I was hired by the same company as the assistant manager to work in their office that managed 5 buildings they own; 5 owned by their daughter and three owned by their son-in-law. I clocked in and out according to the manager; when I sat down to do payroll I was surprised to find that regardless of the number of hours I worked(in excess of eight) I only received pay for7.5 hours. Additionally, I did not receive breaks. When I mentioned this to the manager, I was told that I received comp hours but there was no official record of comp hours that I was shown. Recently, after I complained of this and several other matters, I was let go - however I had pre-paid my August discounted rent of $300. I was not paid the day I was let go and I was not paid for overtime or comp hours. Instead I was asked to vacate immediately, which I refused citing the fact that there was no lease or contract (the owner thought there was a lease and contract but the manager, my immediate supervisor continually put off producing either document.)

I believe overtime violations occurred with the comp time. I am not talking of the class being all current and former employees? Additionally, I feel I am owed my comp hours, my transportation, severance and some sort of compensation for ever being give a lease or contract which I repeatedly asked for...

Lung min yao

on

From 7pm-7am 2 times a week

So I wanna to know if this shift consider as overtime?? Even I just work 23 hours a week?? Thanks

And if overtime is this overtime count from 8?or after 10hours?